Decoding Annuities

Annuities 101How do I determine what it isand if an annuity is right for me?

How does an annuity work?

Some annuity products are funded with a one-time contribution, while others allow for future premium payments to be made.

When the time comes to start receiving payments, also referred to as “distribution,” you will receive those payments based on factors including your age, your annuity’s accumulated value, and more.

What can an annuity do for you?

An annuity can help those preparing for retirement balance their desire to both preserve and grow their future retirement income, while helping manage market volatility and risk.

Tax deferral

Annuities can help you increase savings because you won’t pay taxes on growth until you withdraw money.

Growth potential

An annuity has the potential to provide solid growth on your money while also helping manage risk of loss.

Risk management

Annuities can provide protection from market risk while providing true diversification in your portfolio.

Lifetime Income

Opportunity to produce a predictable guaranteed stream of lifetime income you will not outlive

Is an annuity right for me?

- You’re saving for retirement

If you’re already contributing the maximum to other retirement plans, like an IRA or 401(k), an annuity can be an attractive retirement planning option that grows tax-deferred. - You won’t need the money soon

You don’t anticipate needing money from savings prior to turning 59½. - You’re worried you might outlive your savings

Annuities can provide guaranteed income for the rest of your life, whether you live to be 100 or even 120. - You want to leave a legacy

With an annuity, you can provide your loved ones with a death benefit in the event of your death. - You’re looking for tax-deferred growth.

Generally, that means you won’t pay taxes until you withdraw money from your annuity. - You want guaranteed growth at a set rate

Annuities 101

Annuity Essentials

Understanding the various primary annuity options and how they align with your overall financial strategy simplifies the decision-making process regarding whether and when to incorporate an annuity into your financial portfolio.

What is an Annuity & when do I need one?

Annuities provide insurance against the risk of outliving your money after you stop working. You get the potential to grow your savings and create guaranteed income for life so you can retire your way.

While they seem to function like an investment (that is, you put your money in and accept the risk of whether it increases or decreases), many are actually insurance contracts. In general, if you follow the rules of the contract, you receive certain guarantees in return.

When you might need an annuity

If you’re in one or more of these situations, an Athene annuity might be exactly what you need.

- You’re saving for retirement

If you’re already contributing the maximum to other retirement plans, like an IRA or 401(k), an annuity is an attractive retirement planning option that grows tax-deferred. - You won’t need the money soon

If you don’t anticipate needing money from savings prior to turning 59 ½, then an annuity may be a good option for you. - You’re worried you might outlive your savings

Annuities can provide guaranteed income for the rest of your life, whether you live to be 100 or even 120. It could happen. - You want to leave a legacy

With an Athene annuity, you can provide your loved ones with a death benefit in the event of your death.

What is an Annuity…

and when do I need one?

4 important things to know about FIAs

1. Money in annuities grows tax-deferred.

You only pay tax when you receive money from your annuity.

2. FIAs can offer higher potential interest credits than fixed rate alternatives.

Fixed rate annuities have a set interest rate, regardless of how the market performs. FIAs react to the performance of an underlying index. When the market performs well, the owner of the FIA can benefit. If the market performs poorly, it is possible to earn 0% interest, but never less than zero. A FIA can continue to provide growth potential, while also serving as a risk mitigator within your portfolio.

3. Any interest you earn is locked in and can’t be lost to future market downturns.

With a FIA, any interest you earn when the market is up isn’t lost if the market goes down. The money remains locked in once the interest is credited to your account. The way interest is credited depends on the strategy you choose. These strategies use caps, participations rates, or spreads to calculate the amount of interest you earn. Understanding how interest is credited is an important step in assessing how the FIA will work within your portfolio. Charges (for a rider, for example) can reduce the accumulated value.

4. Optional riders can offer guaranteed income, an enhanced death benefit or liquidity options.

Many consumers appreciate the customizability of a FIA. Riders can provide additional benefits, like guaranteed income or a legacy, that can help you reach your financial goals. Riders are optional elements of the FIA. These can include guaranteed income (regardless of index performance,) a death benefit that would be paid out to your beneficiary in the event you pass away before the end of the contract, or options that allow you to tap the FIA for liquidity if needed. Riders can help ensure that the FIA helps you best navigate your retirement income plan.

4 Important Things…

to know about FIA’s.

Primary annuity vehicles are...

Single Premium Immediate Annuities (SPIAs)

An immediate annuity helps make retirement planning easier because it’s predictable. In exchange for a lump sum of money, an immediate annuity pays a guaranteed amount for a specified time period, including as long as you or your spouse live.

Fixed Annuities

A fixed annuity provides you with tax-deferred growth at a fixed rate of interest set by the annuity provider for a period of time specified in the annuity contract. It also offers the opportunity to produce a guaranteed stream of retirement income you cannot outlive.

Fixed Indexed Annuities (FIAs)

With a fixed indexed annuity, the interest on a portion of your premium is tied, in part, to a published stock market index, giving you the opportunity to benefit from market trends without owning stocks. Your principal is protected from loss due to market downturns. A fixed indexed annuity may also include or offer optional riders that can be purchased or automatically attached to the annuity for a charge. Rider features vary by product, and can offer benefits like lifetime income, increased liquidity, or a death benefit option.

Variable Annuities (VAs)

Variable annuities allow for direct investment in sub-accounts similar to mutual funds. While VAs offer higher growth potential, they also have higher risk than other annuities. For that reason, most people purchase variable annuities when they have the ability (and risk tolerance) to absorb the impact of market declines.

Primary Annuities

types briefly described.

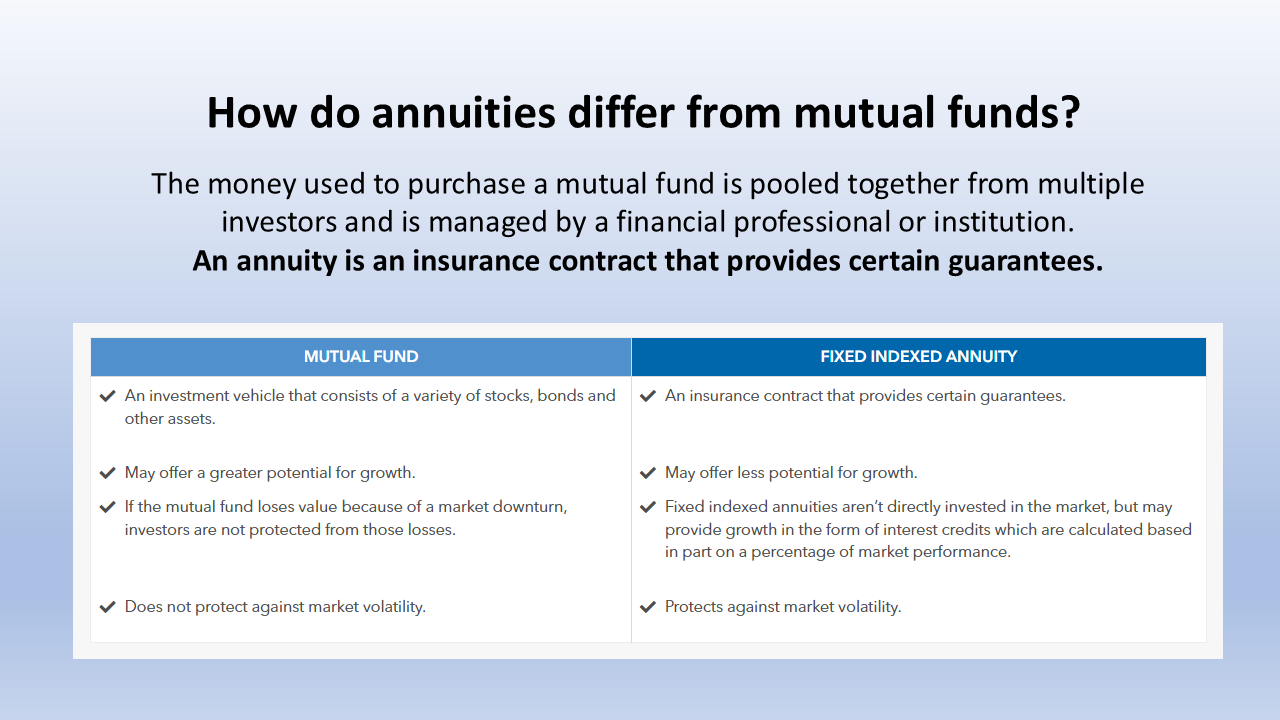

How do Annuities…

differ from mutual funds?

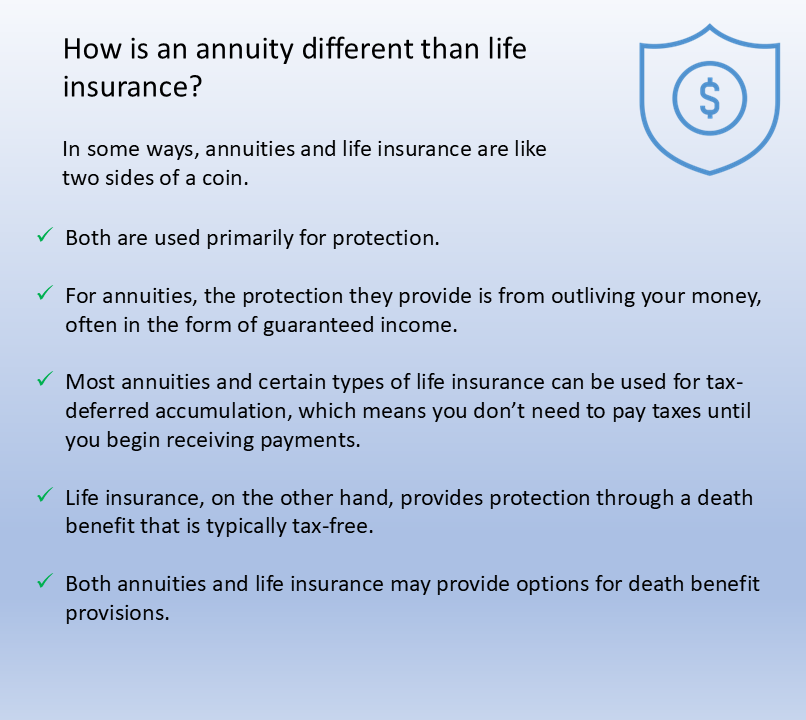

How is an Annuity…

different from Life Insurance?

Tax-Deferred?

Qualified VS Non-Qualified?

Six Fixed Indexed Annuity Myths Busted!

Myth — Fixed indexed annuities are full of hidden charges.

Financial professionals and the insurance company that issues the contract must disclose any and all fees associated with annuities. They must clearly explain withdrawal charges, which may be incurred if you surrender the contract during the withdrawal charge period or withdraw money beyond the penalty-free amount allowed in the contract.

But not all FIAs are the same, and understanding the difference among products can help you choose the FIA that’s right for you. When you purchase a FIA, you can allocate your premium among one or more interest crediting strategies. While your money is not invested directly in the index, you may receive interest credits based partly on how the index performs. These strategies vary from product to product and may include management fees, along with caps, participation rates, and spreads, which may limit the interest credited in exchange for protection from stock market risk or losses. There may also be a charge for optional riders. Rider features also vary by product and can offer benefits like lifetime income, increased liquidity, or an enhanced death benefit.

Myth — Fixed indexed annuities are not tax efficient.

Fixed indexed annuities are long-term, tax-deferred products and can be a valuable solution for those looking to grow their retirement savings. Annuity earnings will grow on a tax-deferred basis until you begin taking withdrawals or surrender the annuity.* Over time, you will have the potential to build more retirement savings than you would have been able to had your earnings been taxed as income. However, there is no additional tax benefit associated with funding a FIA from a tax-qualified source like a 401(k) plan.

Myth — Fixed indexed annuities can’t keep up with inflation.

Since inflation can decrease the purchasing power of your savings, a FIA with an income rider may offer payout rates that are indexed to inflation. This can help you keep pace with the rising cost of goods and services and offset the effects of inflation on your retirement savings. The other thing to remember about a FIA is that it can provide a guaranteed stream of income during retirement while offering growth potential and risk mitigation. Keep in mind that a FIA is just one tool in your portfolio, while you may employ other tools for long-term growth. Talking with a financial professional can help you assess how you can optimize your portfolio during your retirement years to help ensure that it can keep up with inflation, continue to grow, and help you reach your financial goals for the future.

Myth — Fixed indexed annuities are not liquid.

It’s important to remember that FIAs are designed to help meet your needs for long-term retirement savings and income. In exchange for tax-deferred growth potential, protection from market loss, and the potential for guaranteed lifetime income, FIAs have limited liquidity compared to some other products. However, in most cases, FIAs allow you to withdraw up to a specified percentage of the contract’s accumulated value each year during the withdrawal charge period without any charges. Once the withdrawal charge period has ended, funds may be withdrawn without any charges.

Myth — Fixed indexed annuities are investments.

Fixed indexed annuities are insurance products that are designed to help you manage certain financial risks associated with retirement, such as volatile markets, falling interest rates, and longevity. They do not directly participate in any stock or equity investments, so your principal is protected from loss due to market downturns. That said, the interest on a portion of your premium is tied, in part, to a published stock market index, giving you the opportunity to benefit from market trends without owning stocks. This is where a FIA provides the dual benefit of growth potential and risk mitigation.

Myth — You don’t need life insurance and an annuity.

While some life insurance policies can offer growth potential and annuities can include death benefits, the two vehicles serve distinctly different purposes. Life insurance policies are designed primarily to provide for your loved ones in the event you pass away. Annuities, on the other hand, can provide you and/or your partner with guaranteed income while you’re alive. In many cases, you can benefit from having both.

AIL Helps Cover All Aspects of Your LIRP

Gain true diversification in your retirement portfolio with a LIRP as part of it.

Matched dollars in a 401(k) may provide an advantage, but guarantees & tax benefits in LIRP’s make a solid option for your retirement portfolio.

Grows Tax-Free

Produces Tax-Free Income

Does Not Trigger Social Security to be Taxed

Delivers Liquidity Prior to Age 59 1/2

Growth That is Guaranteed & Predictable

You Leave a Legacy Income Tax-Free

Requires No 1099 Reporting

Warehouse for Capital Growth

Provides Significant Opportunity to Enhance Investments

Enhances Tolerance in Other Risky Portfolios

There is No Volatility

No Broker Fees

$$$