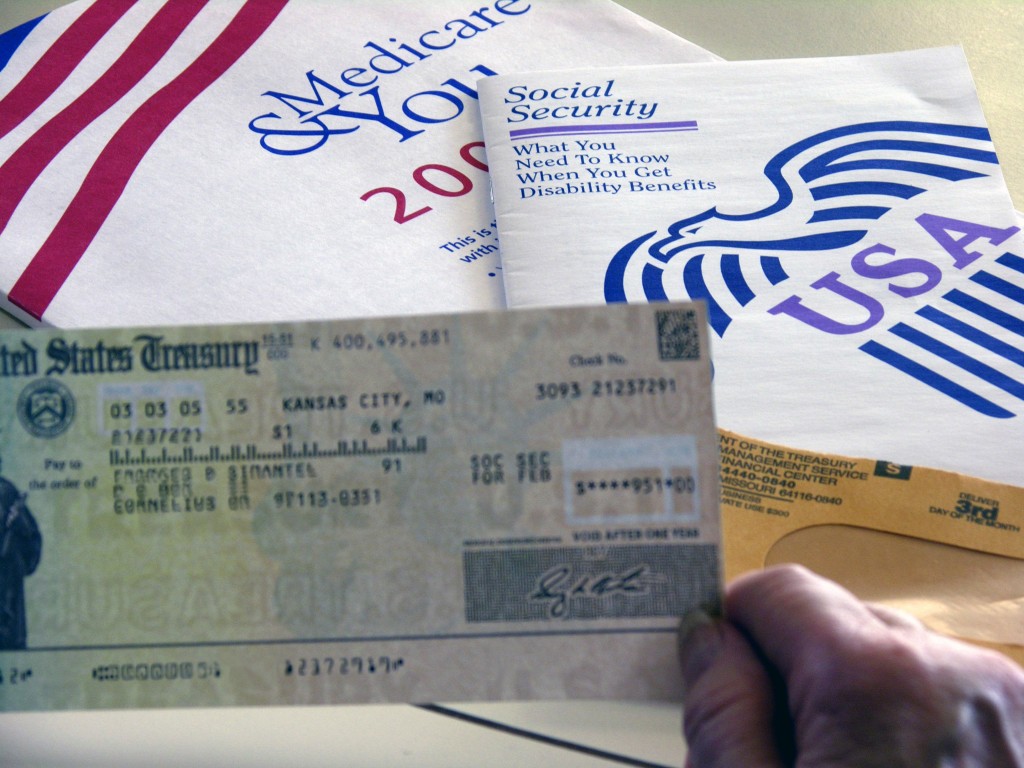

HOW MUCH DOES SOCIAL SECURITY PAY

How do I determine how much Social Security will pay?

Social security is a federal program that provides lifetime income to retired and disabled workers. To qualify for social security, you must have worked for a minimum of 10 years, which is equivalent to 40 credits. Knowing how social security benefits are calculated can help you budget for your retirement.

The amount you receive in social security payments depends on the age when you start collecting your benefits and your earnings history. On average, you can expect to receive $1,657 in social security benefits every month in 2022. The maximum benefit a retiree can get is $3,345 every month in 2022 for an individual who has attained the full retirement age. If you delay taking these benefits until you are 70, the highest amount you can claim is $4,194.

Who is eligible for social security benefits?

You are eligible to start receiving social security benefits if you have paid into Social Security for at least 40 calendar quarters, which is equivalent to 10 years. However, the actual benefits payouts depend on your age when you begin to claim the benefit.

You can receive the full social security benefits once you attain the full retirement age, which can be 66 or 67, depending on the year when you were born. However, you can be allowed to claim benefits as early as age 62, but you will receive reduced benefits than if you would have waited until you reach the full retirement age. If you put off taking benefits until 70, you will get larger monthly benefits.

How social security benefits are calculated

The Social Security Administration (SSA) evaluates benefit payments based on the 35-highest earning years of your career. If your career spanned more than 35 years, SSA drops the lowest-earning years, which boosts your overall earnings. However, if you worked for less than 35 years, SSA gives you a zero for each year you didn’t work, which lowers the potential benefits.

The SSA adjusts all earnings before 60 for inflation. This means that, even if your earnings have increased over the years, the current year’s earnings may not be the highest after indexing for inflation. Also, SSA makes the annual cost of living adjustments, and the benefits you collect have built-in protection against inflation.

If you are eligible to start collecting social security benefits in 2022, your initial benefit is obtained by multiplying the first $1,024 of average indexed monthly earnings (AIME) by 90%. The remaining earnings up to $6,172 are multiplied by 32%, and any earnings above $6,172 are multiplied by 15%. These amounts are then added up and rounded to the nearest 10 cents to get the initial payment amount.

For example, assume that Mary is 62 in 2022, and wants to start claiming social security immediately. Her AIME has been determined as $7,000. Therefore, to know how much Mary will receive in social security benefits, we use the following formula:

First bend point: $1,024 x 90% = $921.60

Second bend point: ($6,172-$1,024) x 32%= $1,647.36

Excess: ($7,000 – $6,172) x 15%= $124.20

The total is $2,683.16 rounded off to $2,618.10.

Is there a maximum social security benefit?

There is a limit on the amount you can receive in social security benefits. The maximum benefit changes each year, and it depends on your age when you start claiming benefits. If you are 62 when you claim payments, the maximum possible benefit is $2,364 each month in 2022.

If you wait until you reach the full retirement age of 66 or 67 depending on the year when you were born, you could be eligible to receive as much as $3,345 each month in 2022. If you are 70 when you claim payments, you can receive the highest possible payments of $4,194 each month in 2022.

If you want to qualify for the maximum social security benefits, you will need to consistently earn a higher salary for at least 35 years. In 2022, the maximum wage taxable by social security is $147,000, up from $142,800 in 2021.

Is social security taxable?

When filing taxes as an individual, you won’t owe any taxes on your social security payments if your total earnings (social security and other earnings) are below $25,000. If your earnings are in the $25,000 to $34,000 range, you will pay taxes on up to 50% of your benefits. If your income is above this range, you will pay taxes on up to 85% of your benefits.

If you are a married couple filing taxes jointly, you will pay taxes on half of your social security benefits if you have a joint income of $32,000 to $44,000. If the combined income exceeds $44,000, you will owe taxes on up to 85% of your taxable income.

AIL Helps Cover All Aspects of Your LIRP

Gain true diversification in your retirement portfolio with a LIRP as part of it.

Matched dollars in a 401(k) may provide an advantage, but guarantees & tax benefits in LIRP’s make a solid option for your retirement portfolio.

Grows Tax-Free

Produces Tax-Free Income

Does Not Trigger Social Security to be Taxed

Delivers Liquidity Prior to Age 59 1/2

Growth That is Guaranteed & Predictable

You Leave a Legacy Income Tax-Free

Requires No 1099 Reporting

Warehouse for Capital Growth

Provides Significant Opportunity to Enhance Investments

Enhances Tolerance in Other Risky Portfolios

There is No Volatility

No Broker Fees

$$$